The Reserve Bank of India (“RBI”) has thrown a curveball at the short-term debt market with its sweeping revisions to the norms governing commercial papers (“CPs”) and short-term non-convertible debentures (“STNCDs”). Effective April 1, 2024, these revised guidelines not only streamline existing regulations but also fundamentally reshape the relationship between these two instruments, raising pertinent questions about security mechanisms and future market dynamics.

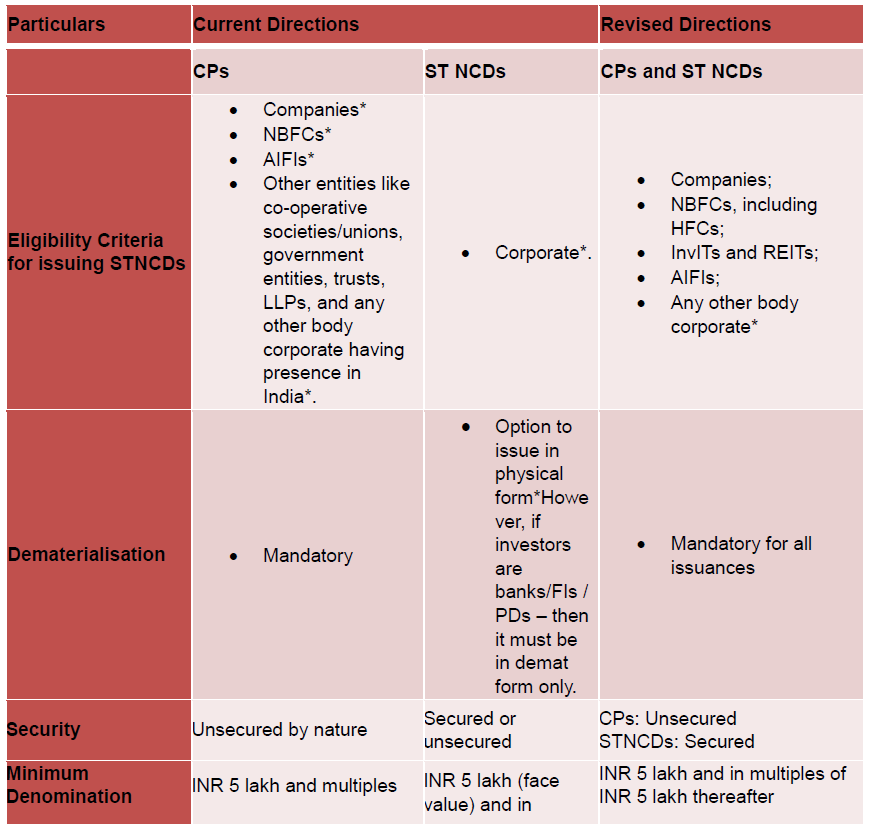

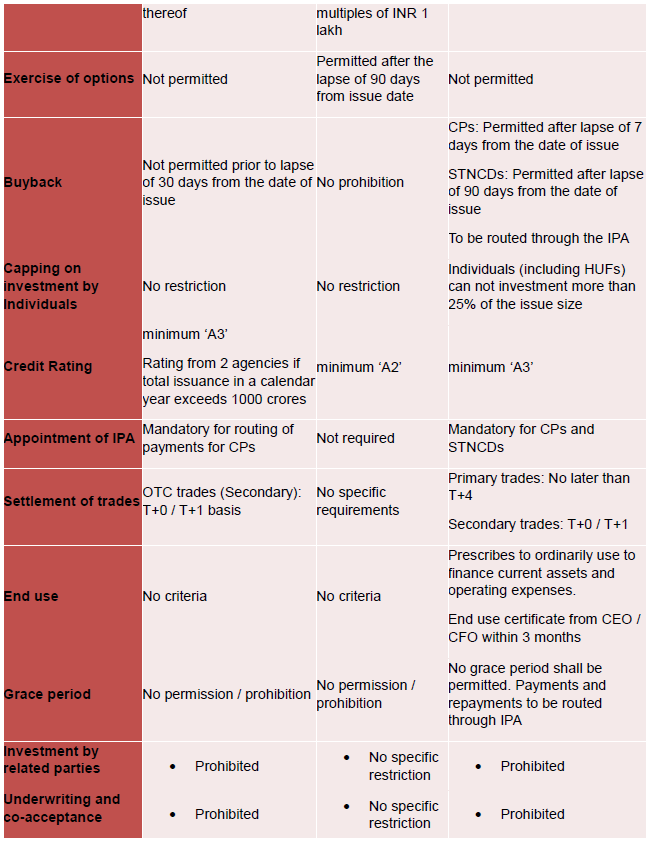

One of the most striking aspects of the revised guidelines is the deliberate effort to put CPs and STNCDs on equal footing. Currently CPs are governed by the Reserve Bank Commercial Paper Directions dated 10th August 2017 and STNCDs are governed by the Section IV of the Master Direction on Money Market Instruments: Call/Notice Money Market, Commercial Paper, Certificates of Deposit and Non-Convertible Debentures (original maturity up to one year) dated 07th July 2016 (collectively “Current Directions”). Effective April 1, 2024, the Current Directions are proposed to be replaced with Master Direction – Reserve Bank of India (Commercial Paper and Non-Convertible Debentures of original or initial maturity upto one year) Directions, 2024 dated 03rd January 2024 (“Revised Directions”). We have set out below a snapshot of the comparison between the Current Directions for CPs and STNCDs and the Revised Directions.

Analysis of the changes:

- Eligibility Expansion: The issuer base is significantly broadened. ReITs and Invits have now been specifically permitted to raise funds by way of CPs and STNCDs. Further, the net worth requirement for a company issuing STNCDs has been done away with and only other body corporates issuing such instruments need to have a net worth requirement. Additionally, the requirement under the Current Directions for a company to have been sanctioned working capital limits to be eligible to issue STNCDs has been done away with.

- Minimum Face Value: Both instruments now boast a minimum face value of INR 5 lakhs, catering to larger transactions and fostering institutional participation.

- Dematerialization Mandate: Both CPs and STNCDs must be dematerialized, ensuring transparency, and reducing settlement risks.

- Structuring Concerns: Both CPs and STNCDs shed call/put options thereby fostering simpler structures. Accordingly, transaction with put/call events will no longer be possible. A company is however permitted to buyback these instruments which will however have to be provided to all.

- Settlement Timeline: It is pertinent to note that the timeline for settlement of trades in the primary market have been stipulated at T+4 from the deal date, i.e. the day on which trade details including the price / rate are agreed between the parties. The timeline starts ticking from the date on which the commercials / term sheet is frozen itself and not only the issue opening / closing date, which is a significant change from the current norms.

- Appointment of Issuing and Paying Agent for STNCDs: The Revised Directions have mandated appointment of an IPA even in case of STNCDs for routing payments to and from the issuer to the investor. The IPA has to provide an IPA certificate as well before funding. There has been no rationale provided for introducing the said change. It appears that the same has been introduced to bring out parity between the two instruments.

Conclusion The Revised Directions are a mixed bag of changes that have been introduced which aim for parity between issue of CPs and STNCDs given both are short term instruments. While we observe that there has been introduction of quite significant changes to the operations and functioning of the STNCDs, especially by introduction of issuing and paying agent(s) for STNCDs, we also understand that the horizon for the CP markets shall be widened by the new relaxations to the eligibility criteria for issuances. The RBI has also positively attempted to consolidate the fragmented and scattered framework for short term financing.